The "Right Product"

Regardless of industry, the "right product" is the offering that satisfies the customer's wants or needs.

For example, in the Vacation Rental (VR) industry, the "right product" for a business traveler might be a studio or 1-bed apartment with great Wi-Fi, a working desk, and (of course!) blackout shades.

Similarly, the "right product" for friends traveling to Lake Tahoe may well be a 5-bedroom house, ideally with a pool, hot tub and foosball table.

In our industry, amenity-rich, unique, well-located, well-photographed spaces are "in."

These unique spaces present both a challenge—and an opportunity—for revenue growth via effective revenue management practices.

The "Right Customer"

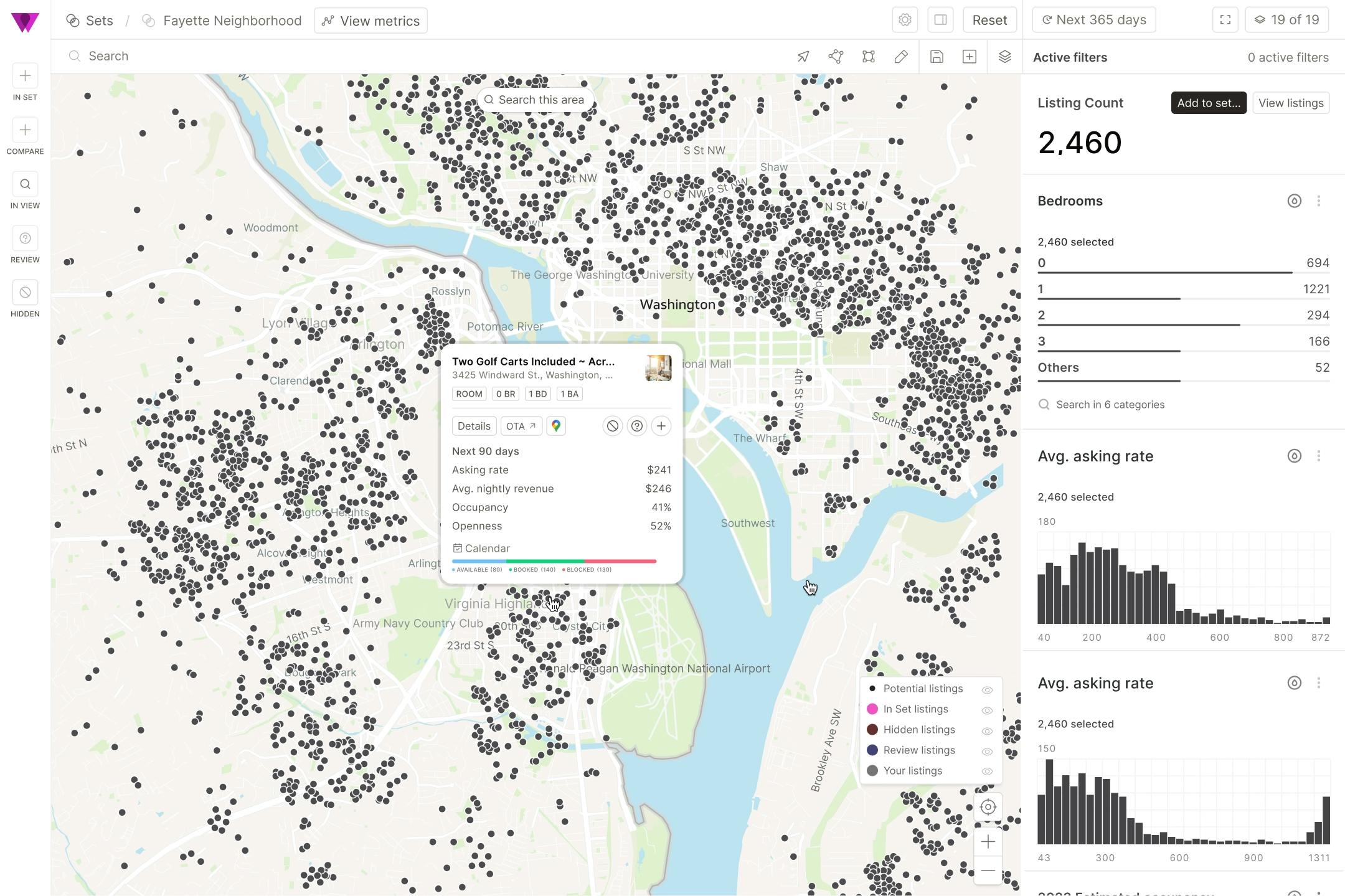

Finding the "right customer" is all about identifying and targeting customer segments who value the product you sell.

In the above example, you clearly would not want to spend time marketing to - and designing for - large groups if you were managing a studio apartment.

In the VR space, travelers can filter by a broad set of amenities to find their ideal property.

Therefore, finding the "right customer" is all about deeply understanding the types of travelers who seek your inventory, and then better optimizing your online listings, direct site, and marketing efforts to reach & resonate with a similar demographic of travelers.

In the VR industry, the "right customer" is also someone who will treat your property with care!

The "Right Price"

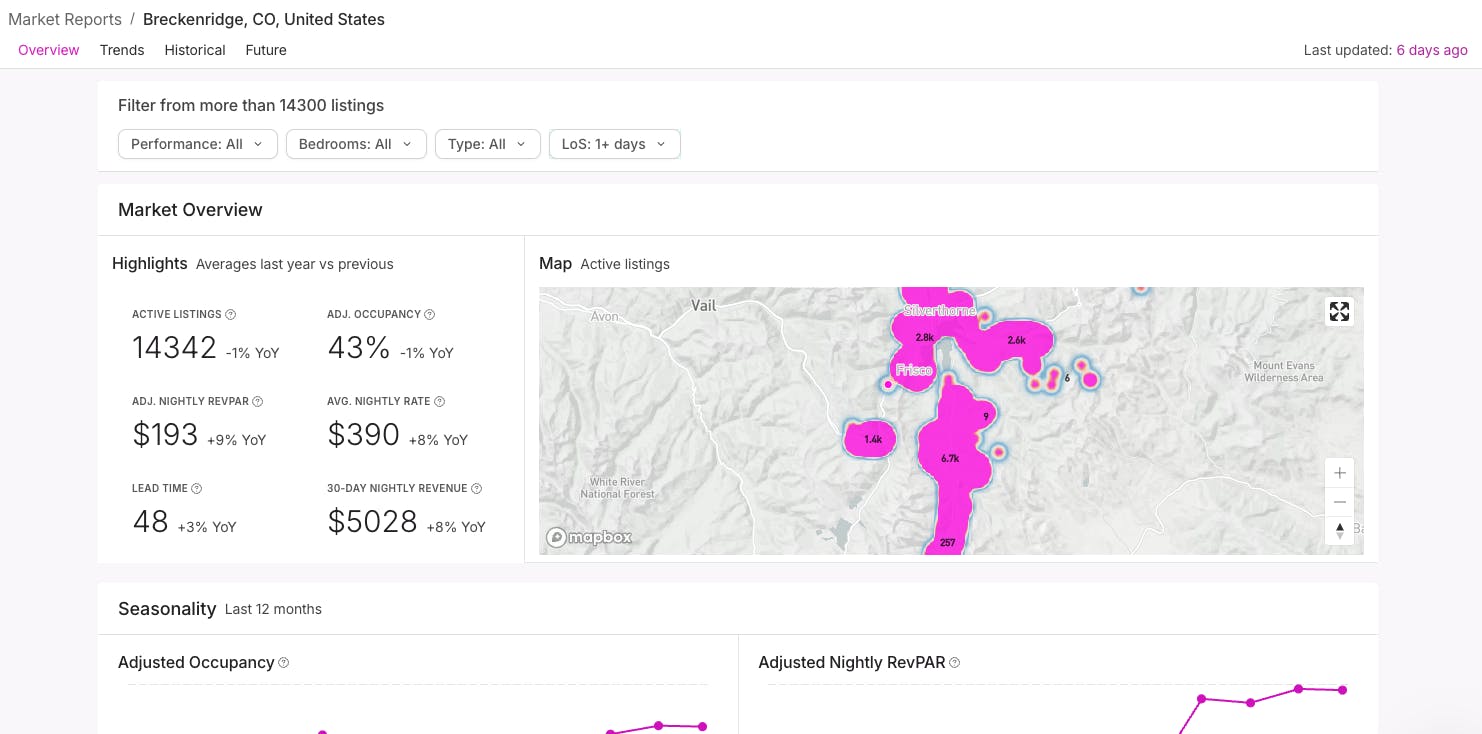

In the VR space, the "right price" is shorthand for figuring out what the market is willing to pay—on a given day—for your unique property.

This "right price" varies over time, as stay dates approach, market conditions change, inventory levels fluctuate, weather patterns emerge, etc.

And, in many ways, the biggest challenge for revenue management in the VR space is, "How can you optimally price a unique asset, when you can only sell each night one time?!"

While perfection is impossible, this guide will help you price more accurately, more often, in a manner that will consistently maximize your revenue.

The "Right Time"

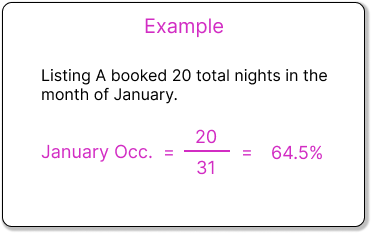

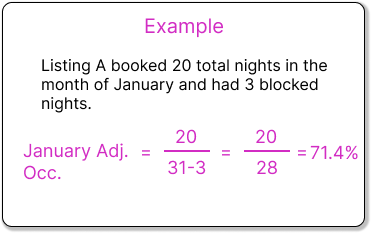

Another adage of Revenue Management is that you "can never sell last night's vacancy."

Therefore, the challenge of any revenue manager is to avoid vacancies (unbooked nights earn $0) while also not selling at too low a price.

This tension is even more acute in the VR space, where property & revenue managers work on behalf of many individual owners.

Each individual owner only recieves revenue if their property books, and explaining to an owner why any holiday weekend was vacant can be... challenging!

Understanding seasonality and booking windows—which we discuss in this chapter and put to use in later chapters—will be key to understanding "the right time" to sell your inventory.

The "Right Channel"

Distribution is a key aspect of an effective Revenue Management strategy.

And, distribution channels (often called OTAs or booking channels) such as Airbnb, Booking, VRBO, and other specialty sites often charge a percentage of revenue for each booking.

In exchange, these sites have the potential to bring you more (and ideally, new) customers.

Additionally, if you advertise in online or traditional media, each advertisements cost money as well.

Generally, you will earn the most money by selling directly to your customers via your website, direct email/outreach, or any other means where your team can process the booking without giving away a large percentage (often 15%+) of your revenue.

But, since monetizing via OTAs/channels is an important component of essentially all distribution strategies, making sure you optimize your listings on these channels (given their unique customer mix) is a critical aspect of driving revenue.